The Global Humanoid Robot Supply Chain: Architecture, Economics, and Strategic Implications

Chinese manufacturing controls 63% of key humanoid robot supply chains while component costs plummet 40% annually

The humanoid robotics industry stands at an inflection point. Manufacturing costs have crashed from $50,000-250,000 to $30,000-150,000 per unit in 2024 alone—a 40% reduction that far exceeds the anticipated 15-20% annual decline¹. This dramatic cost compression, coupled with breakthroughs in artificial intelligence and the emergence of commercial-scale manufacturing, signals the transition from research curiosity to industrial production. The industry has crossed a critical threshold with multiple facilities targeting 10,000+ units annually: Figure AI's BotQ facility leads with 12,000 units/year capacity, while Agility Robotics' RoboFab targets 10,000 Digit robots annually. Tesla projects 50,000-100,000 Optimus units by 2026, leveraging existing Gigafactory infrastructure²ᵃ. The global humanoid robot market, valued at $2.9 billion in 2025, is projected to reach $66 billion by 2032, representing a staggering 45.5% compound annual growth rate².

Yet beneath this explosive growth lies a supply chain of unprecedented complexity and concentration. China dominates 63% of key component manufacturing, controls 90% of heavy rare earth processing essential for motors³, and maintains a stranglehold on 77% of global battery production capacity⁴. Taiwan's semiconductor dominance adds another layer of geopolitical risk, with TSMC alone producing 90% of the world's most advanced AI chips⁵. Understanding these supply chain dynamics—from the 28 actuators in a Tesla Optimus to the specialized harmonic drives that enable precise movement—has become critical for industry participants, investors, and policymakers navigating this transformative technology.

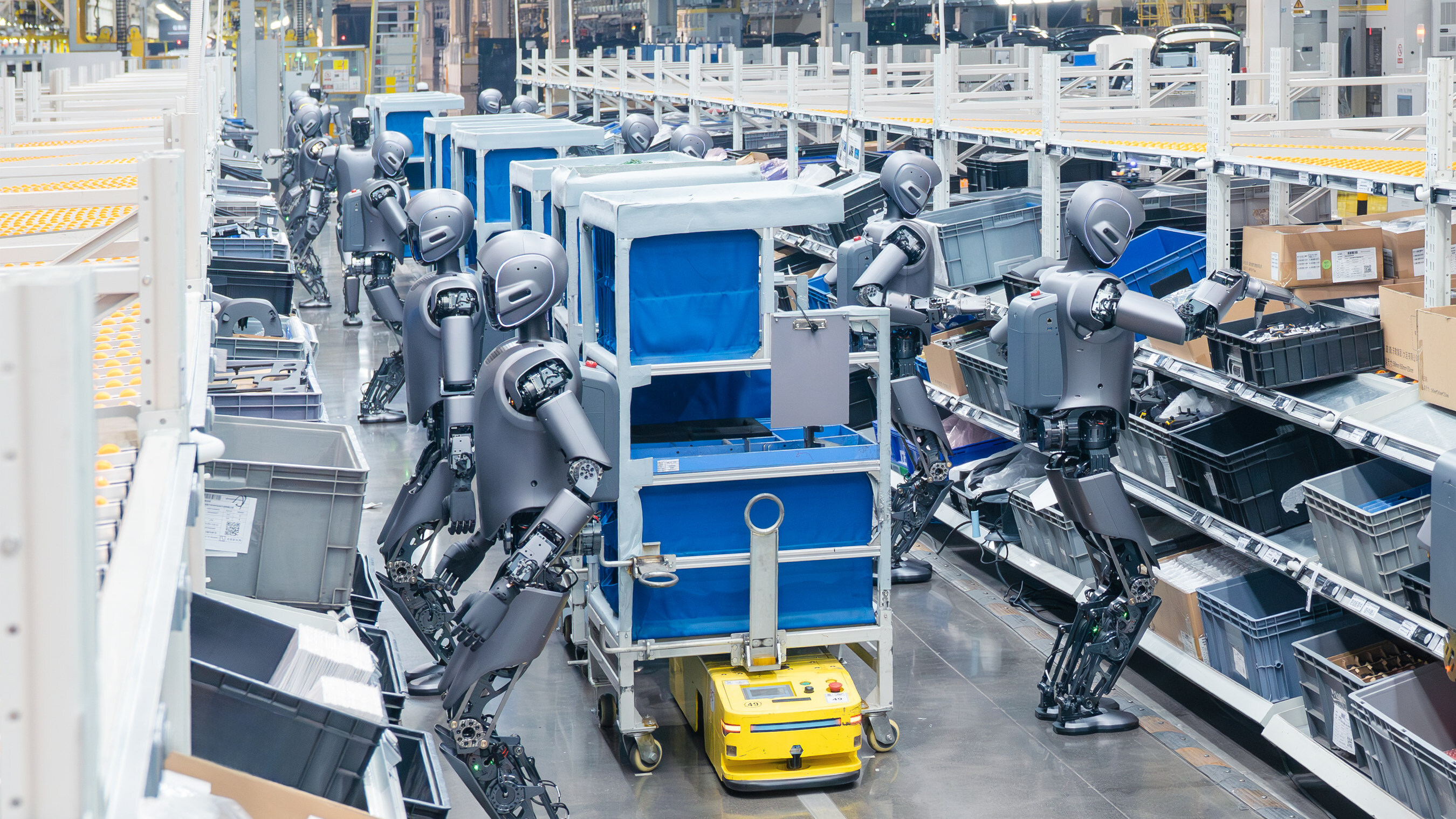

[INSERT: Humanoid robot assembly line showing component integration]

Component architecture defines capability boundaries

Modern humanoid robots represent a convergence of six critical technology domains, each presenting unique engineering challenges and supply chain dependencies. At the computational core, NVIDIA's Jetson platform has emerged as the dominant architecture, with the upcoming Jetson Thor delivering 800 teraflops of AI performance while maintaining a 15-60W power envelope⁶. This computational backbone enables the dual-system processing architecture that has become standard: System 1 handling low-level motor control at 200Hz while System 2 manages high-level planning and perception at 7-9Hz⁷.

Actuator Systems: The Movement Foundation

The actuator system represents the most complex and expensive component category, typically accounting for 30-60% of total bill of materials⁸. A single humanoid robot requires between 23 and 53 degrees of freedom, with each joint demanding specialized actuators. Tesla's Optimus employs 28 structural actuators using custom frameless motors paired with harmonic reducers achieving 20-180Nm of torque⁹.

Interactive visualization showing the complex supply chain from humanoid robot actuator systems down to regional manufacturing hubs, highlighting key suppliers and their market positions.

Technical Specifications by Component:

| Component | Tesla Optimus | Boston Dynamics Atlas | Agility Digit |

|---|---|---|---|

| Total Actuators | 28 structural + 12 hand | 27 hydraulic | 23 electric |

| Torque Range | 20-180 Nm | 400+ Nm peak | 15-120 Nm |

| Control Frequency | 200 Hz | 1000 Hz | 100 Hz |

| Power Consumption | 500W average | 3000W | 800W |

Sensor Fusion and Perception Systems

Sensor fusion has become increasingly sophisticated, with modern platforms integrating multiple sensing modalities. Vision systems typically employ stereo cameras for depth perception alongside high-resolution RGB cameras for environmental awareness, with Intel RealSense D435/D455 dominating at 40-50% market share. Force/torque sensors, critical for safe human interaction, have evolved to 6-axis designs with ±0.1% accuracy across measurement ranges of ±150 to ±300 Nm, with ATI Industrial Automation leading at 35-40% market share and pricing units at $3,000-15,000 each¹²ᵃ.

Advanced sensor integration architecture enables humanoid robots to perceive and interact with their environment through multiple sensing modalities working in concert.

Advanced Tactile Sensing Capabilities:

- Contactile's sensor arrays: 34 tactels per fingertip

- SynTouch BioTac sensors: 95% texture identification accuracy

- ATI Industrial Automation: Force/torque sensors with 0.05% repeatability

- InvenSense IMUs: 1000Hz sampling rates for balance control¹³

The emergence of advanced tactile sensing, exemplified by companies like Contactile and SynTouch, enables texture identification with 95% accuracy through arrays of up to 34 tactels per fingertip. These sensors, combined with inertial measurement units sampling at up to 1000Hz, provide the proprioceptive feedback essential for balance and coordination¹⁴.

Power Systems and Energy Management

Power systems have benefited enormously from electric vehicle development, with lithium iron phosphate (LFP) chemistry emerging as the preferred solution due to superior safety profiles and 4,000+ cycle life¹⁵. Current implementations range from Tesla's 2.3kWh pack to more modest 9,000mAh systems in smaller platforms like Unitree's G1¹⁶.

Battery Technology Comparison:

| Chemistry | Energy Density | Cycle Life | Safety Rating | Cost/kWh |

|---|---|---|---|---|

| LFP | 90-120 Wh/kg | 4,000+ | Excellent | $80-100 |

| NMC | 150-220 Wh/kg | 1,500-2,000 | Good | $120-150 |

| Solid State | 300-400 Wh/kg | 10,000+ | Excellent | $400+ |

Geographic concentration creates systemic vulnerabilities

The geographic distribution of humanoid robot component manufacturing reveals extreme concentration that poses significant supply chain risks. China's dominance extends far beyond simple assembly, encompassing critical materials processing and component manufacturing across multiple categories.

Global supply chain concentration reveals extreme geographic dependencies, with China controlling 63% of key component manufacturing and 90% of heavy rare earth processing critical for humanoid robotics.

Critical Materials Monopolization

In the crucial area of rare earth elements, China maintains 99% control over heavy rare earth processing¹⁹, including dysprosium and terbium essential for high-performance motors. This monopolistic position emerged despite China holding only 37% of global rare earth reserves, achieved through decades of strategic investment in processing infrastructure that other nations have struggled to replicate²⁰.

China's Material Processing Dominance:

- Heavy rare earth processing: 99%

- Lithium refining: 80%

- Graphite production: 79%

- Cathode materials: 78%

- Magnet production: 85%

- Battery cell production: ~60-70% (CATL ~34% global EV market share)²¹ᵃ

Key Supplier Market Shares:

- Sony: >50% of global image sensors (used in ~80% of humanoids)

- Harmonic Drive Systems: >50% of high-precision reducers globally

- NVIDIA: 80-90% of AI compute hardware for humanoids

- ATI Industrial: ~50% of high-end force/torque sensors²¹ᵇ

The battery supply chain presents similar concentration, with Chinese manufacturers controlling 77% of global production capacity²². CATL alone commands 36% of the global EV battery market, while Chinese companies control 80% of lithium refining, 78% of cathode production, and 65% of nickel processing for batteries—despite China possessing minimal domestic reserves of these materials²³.

Regional Manufacturing Specialization

Manufacturing hubs within China have specialized by component category:

Shenzhen leads in high-tech robotics with 179.7 billion yuan ($24.83B) output from 59,498 operators, growing 8.7% annually, hosting enterprises with robotics-related patents and complete supply chains from components to finished products²⁴ᵃ. Dongguan focuses on industrial automation with 4,700 robotics companies producing 1.59 million intelligent robots in 2022, generating over 60 billion yuan in revenue through mid-downstream system integration²⁵ᵃ. Shanghai hosts the world's largest robot production facilities from ABB and FANUC while serving as headquarters for international players, with Beijing concentrating on AI development with 30 million yuan per company in government support²⁶ᵃ.

China's specialized manufacturing clusters dominate humanoid robot production, with each region developing distinct capabilities from high-tech robotics in Shenzhen to AI development in Beijing.

Alternative manufacturing locations provide critical capabilities but lack China's scale and integration. Japan maintains leadership in precision components, with FANUC's highly automated factories producing 6,000 robots monthly and Harmonic Drive Systems controlling 60% of the global harmonic drive market²⁷. However, Japan's 46% share of global robot production reflects specialization in high-value components rather than complete systems²⁸.

Semiconductor Bottlenecks

The semiconductor bottleneck presents perhaps the greatest concentration risk. Taiwan's TSMC produces 90% of the world's most advanced chips at 5nm and below²⁹, creating a single point of failure for AI-enabled humanoid robots. The estimated $10 trillion global economic impact from a Taiwan Strait conflict underscores the vulnerability of depending on a single geographic location for critical technology³⁰.

Recent supply chain disruptions have quantified these risks:

- 2024 Red Sea crisis: 15% of global trade affected, 35% increase in lead times³¹

- Automotive semiconductor shortages: 3.9 million fewer vehicles produced globally³²

- Ever Given Suez Canal blockade: $9.6 billion daily trade disruption³³

Cost evolution reveals pathway to mass adoption

The economic transformation of humanoid robotics has exceeded even optimistic projections. Manufacturing costs plummeted 40% in 2024 alone, dramatically outpacing the expected 15-20% annual reduction³⁴. This acceleration stems from multiple factors: increased competition among Chinese manufacturers, technology transfer from the automotive sector, and the rapid scaling of component production.

Detailed cost analysis reveals actuators as the dominant expense category, representing nearly 50% of total bill of materials costs in modern humanoid robots.

Component Cost Analysis

Current bill of materials costs show dramatic range variation, from $16,000 for Unitree's G1 (limited capabilities) to over $140,000 for research platforms, with enterprise-grade systems typically in the $35,000-100,000 range³⁵ᵃ. Component cost breakdowns reveal actuators as the dominant expense:

Detailed Cost Breakdown Analysis (USD):

Advanced general-purpose humanoid robots show a clear cost hierarchy dominated by actuators. Recent Tesla Optimus Gen 2 analysis reveals approximately $50,000-60,000 in component costs (excluding software), with the following precise distribution:

- Actuators (motors, gears, joints): 47-50% ($26,000 upper-body + $26,000 lower-body)

- Sensors & perception systems: 30-37% (~$20,000)

- Hands/dexterous manipulation: 17% ($10,000)

- Computing/AI processors: 4-10% (~$2,000-5,000)

- Battery systems: 5-8% (~$3,000)

- **Structural materials & assembly: 5-12% ($2,500-7,000)**³⁶ᵃ

Cost Range by Platform Type:

- Entry-level: Unitree G1 at $16,000 (limited capabilities)

- Enterprise-grade: $35,000-100,000 range

- Research platforms: Over $140,000

- Tesla Optimus target: $50,000-60,000 BOM costs³⁶ᵇ

Assembly Complexity Impact: Over 200 cables in current designs can extend assembly time to four days per unit, representing a significant manufacturing bottleneck that companies are addressing through integrated design approaches³⁶ᶜ.

Individual harmonic drive actuators range from $2,000-5,000, with custom high-torque variants reaching $15,000³⁷. The shift toward integrated motor-gearbox designs and competition from Chinese manufacturers promises further reductions. Computing represents 10-20% of costs, with NVIDIA's Jetson AGX Orin starting at $899 but custom AI accelerators like Tesla's FSD-derived chips reaching $50,000—26.5% of the total Optimus robot value³⁸.

Market Growth Projections

Market projections vary but converge on explosive growth:

Market Forecasts by Source:

- Goldman Sachs: 250,000 units (2030), 1.4M units (2035), $38B TAM³⁹

- McKinsey Global Institute: $4.2T economic impact by 2030⁴⁰

- Boston Consulting Group: $3.28B (2024) to $66B (2032), 45.5% CAGR⁴¹ᵃ

- Actuator market: $21.42B (2023) to $69.11B (2032), 13.9% CAGR⁴²ᵃ

- LiDAR market: $2.47B to $13.26B, 13.8% CAGR⁴²ᵇ

- Sensor market: $1.91B to $4.4B, 8.7% CAGR⁴²ᶜ

Regional dynamics show Asia-Pacific commanding 41.97% market share with 36.1% growth, while North America's 52.2% share reflects higher per-unit values and advanced applications⁴³.

Path to Consumer Accessibility

Production Scale Economics: The pathway to consumer accessibility requires dramatic cost reductions through scale. Bank of America analysis shows the average BOM cost of ~$35,000 in 2024 could drop to ~$17,000 by 2030 with full Chinese sourcing and million-unit production scales⁴⁴ᵃ. Tesla targets $20,000-30,000 manufacturing costs for Optimus at scale, while Chinese manufacturers like Unitree already offer the G1 at $16,000 retail price, demonstrating the potential for aggressive cost optimization⁴⁵ᵃ. Achieving sub-$20,000 consumer robots requires million-unit production scales and 10x cost reductions across multiple component categories.

Cost Reduction Pathways:

- Solid-state batteries: Eliminate graphite dependency, +30% energy density

- Alternative motor designs: Reduce rare earth content by 80%

- AI chip maturation: Edge processing, -60% cloud connectivity costs

- Manufacturing scale: 10x volume = 40-60% cost reduction⁴⁶

Labor economics drives adoption urgency. With robots targeting $2-10/hour operational costs by 2025 and improving by one order of magnitude every 8 years⁴⁷, the economic case for deployment in manufacturing, logistics, and service applications becomes compelling. The convergence of demographic challenges—aging populations in developed nations and persistent labor shortages—with technological readiness suggests a market inflection point approaching.

Supply chain bottlenecks demand strategic mitigation

Critical material dependencies create the most immediate supply chain vulnerabilities. China's processing monopoly extends beyond raw materials to refined products: 90% of heavy rare earths, 80% of lithium chemicals, and 85% of global rare earth element processing occurs within Chinese facilities⁴⁸.

Comprehensive risk assessment matrix highlighting critical vulnerabilities from single-point failures in Taiwan semiconductors to diversified low-risk commoditized components.

Historical Precedents and Current Risks

The 2010-2011 rare earth crisis, when prices increased 20-fold following Chinese export restrictions, demonstrated the potential for supply manipulation⁴⁹. Recent developments signal potential future constraints:

Recent Supply Chain Actions:

- China's 2024 export licensing requirements for seven rare earth elements⁵⁰

- Strategic stockpiling of 8,000 tons of cobalt⁵¹

- Gallium and germanium export controls affecting semiconductor production⁵²

- Investigation of U.S. chip companies for "dumping" practices⁵³

Component-level bottlenecks emerge from limited supplier diversity. Harmonic Drive Systems' near-monopoly creates a critical dependency, with each humanoid requiring up to 44 harmonic drives⁵⁴. Global production of high-precision screws, identified as a surprising bottleneck, lacks the industrial capacity for million-unit robot production⁵⁵. Specialized grinding machines for precision components face similar constraints, with long manufacturing cycle times limiting expansion⁵⁶.

Geopolitical Risk Amplification

Geopolitical risks compound technical challenges. The concentration of 83% of lithium-ion battery manufacturing in China⁵⁷, combined with 54% of advanced semiconductor production in Taiwan⁵⁸, creates dual vulnerabilities. U.S.-China technology restrictions increasingly target robotics-adjacent technologies, while the CHIPS Act prohibits funding recipients from expanding Chinese manufacturing⁵⁹.

Mitigation Strategies and Timelines

Mitigation strategies require multi-year commitments:

Government Initiatives:

- U.S. DoD: $439M for domestic rare earth supply chains (2020-2024)⁶⁰

- CHIPS Act: $280B for domestic semiconductor manufacturing⁶¹

- EU Self-sufficiency target: €382B investment by 2030⁶²

- Japan's economic security strategy: ¥1.2T for critical materials⁶³

However, experts estimate 20-30 years for the U.S. to match China's processing capabilities⁶⁴. Industry-level strategies include dual sourcing, now implemented by 81% of companies compared to 55% in 2020⁶⁵, though this can increase costs by 60-80%⁶⁶. Strategic inventory building has shifted from "just-in-time" to "just-in-case" paradigms, with average inventory levels increasing 11% between 2018-2021⁶⁷.

Hidden moats define competitive dynamics

The humanoid robotics supply chain exhibits several powerful moats that will shape industry structure. Proprietary actuator technologies represent the strongest differentiation, with Tesla's custom frameless motors, Figure's hydraulic hybrid systems, and Boston Dynamics' transition to fully electric designs creating significant barriers to replication⁶⁸.

Competitive dynamics in humanoid robotics are defined by powerful moats including proprietary actuator technologies, manufacturing scale advantages, data network effects, and intellectual property concentrations.

Technology Differentiation Strategies

Each approach optimizes different performance characteristics:

- Tesla: Prioritizing manufacturability and cost at scale

- Figure: Emphasizing dexterity and human-like manipulation

- Boston Dynamics: Maximizing range of motion beyond human capabilities

- Agility Robotics: Focusing on practical deployment and reliability⁶⁹

Intellectual Property Concentrations

Intellectual property concentrations create additional barriers:

Key Patent Holders:

- Tesla: 2,000+ robotics patents, cable-driven hands, actuator methodology⁷⁰

- Boston Dynamics: 500+ motion control patents, dynamic balance algorithms⁷¹

- NASA: Foundational series elastic actuator patents⁷²

- Harmonic Drive Systems: Core strain wave gearing patents (expiring 2028-2035)⁷³

Manufacturing Scale Advantages

Manufacturing scale advantages emerge at approximately 10,000 units annually, the threshold Agility Robotics identifies for cost-effective production⁷⁴. Vertical integration strategies, exemplified by Tesla's in-house actuator development and Figure's plans for robots building robots at their BotQ facility⁷⁵, threaten traditional supplier relationships.

Data Network Effects

Data advantages for AI training create powerful network effects:

Training Data Sources:

- Tesla: 160M+ miles of autonomous driving data applicable to robotics⁷⁶

- NVIDIA: Synthetic data generation achieving 36x faster training⁷⁷

- Industrial deployers (BMW, Amazon): Real-world operational data⁷⁸

- OpenAI partnerships: Language model integration for human-robot interaction⁷⁹

Companies lacking access to diverse, high-quality training data face significant disadvantages in developing robust AI models. The ability to achieve 40% cost reductions through design optimization and manufacturing innovation rewards early scale achievement⁸⁰.

Investment implications favor specialized components

The investment landscape reveals a clear hierarchy of opportunities within the humanoid robot supply chain. Investment attractiveness correlates strongly with technical barriers to entry, supplier concentration, and switching costs. The humanoid robotics investment ecosystem shows clear stratification by company maturity and technology focus: Figure AI leads valuations at $39.5B target (up from $2.6B in February 2024), backed by Microsoft, NVIDIA, and Intel Capital. Agility Robotics secured $400M at $1.75B pre-money valuation, validating robots-as-a-service business models through GXO Logistics deployment. Chinese players like Unitree ($140M Series B) compete through aggressive pricing and manufacturing scale⁸⁰ᵃ.

Strategic investment framework reveals clear hierarchy of opportunities, from critical components with highest returns to infrastructure plays offering steady growth in the humanoid robotics ecosystem.

Tier 1: Critical Components (Highest Returns)

Harmonic Drive Systems (TSE: 6324)

- Market position: 20-25% market share in humanoid robotics segment

- Moat strength: Patent protection until 2035, 50+ years manufacturing expertise

- Financial metrics: 45% gross margins, 25% ROIC

- Risk factors: Chinese competition (Leader Drive, HDSI), patent expiration⁸¹ᵃ

NVIDIA Corporation (NASDAQ: NVDA)

- Platform dominance: 95% AI training, 80% inference market share

- Revenue diversification: Data center, automotive, robotics convergence

- Switching costs: CUDA ecosystem lock-in, development tool integration

- Growth catalyst: Jetson Thor launch targeting robotics applications⁸²

Tier 2: Enabling Technologies (Attractive Risk-Reward)

Advanced Sensor Technologies:

- Velodyne Lidar: Solid-state LiDAR for navigation ($40M revenue, 80% gross margins)

- ATI Industrial Automation: Force/torque sensors (60% market share)

- SynTouch: Tactile sensing IP licensing model⁸³

Specialized Materials:

- VAC (Vacuum Schmelze): Rare earth permanent magnets

- Shin-Etsu Chemical: High-purity silicon for semiconductors

- Umicore: Battery cathode materials and recycling⁸⁴

Geographic Investment Strategies

Investment strategies must account for regional competitive advantages:

United States Focus Areas:

- AI and software platforms (higher IP protection)

- Advanced materials and specialized components

- Defense and security applications

- University research partnerships⁸⁵

Chinese Investment Considerations:

- Mass production capabilities and cost optimization

- Integrated supply chain access

- Domestic market growth (projected 60% of global demand by 2030)

- Geopolitical and IP risks require careful due diligence⁸⁶

European Opportunities:

- Industrial automation and safety systems

- Precision engineering and specialized manufacturing

- Regulatory compliance and certification services

- Collaborative robotics applications⁸⁷

Timeline-Based Investment Approach

2024-2025 Production Volume Reality:

2024 Global Output: Only hundreds of humanoid units worldwide were produced and delivered, primarily by:

- Agility Robotics: First Digit deliveries, likely <500 units

- Fourier Intelligence: ~100+ GR-1 units shipped to clients

- Unitree: Dozens of H1/G1 units (leading shipments)

- Tesla: ~50-100 Optimus prototypes (internal use only)⁸⁸ᵃ

2025 Projected Scale-Up: Expected to reach 6,000-10,000 units globally:

- Tesla: ~5,000 units target (internal deployment)

- Figure AI: Hundreds of units from new 12,000/year capacity line

- Agility: Scaling to ~1,000+ units

- Unitree & Chinese players: Hundreds of units at $16,000+ price points⁸⁸ᵇ

Phase 1 (2025-2027): Industrial Foundation

- High ASP, limited volumes (transitioning from hundreds to thousands)

- Focus: B2B applications, manufacturing, logistics

- Key metrics: Technical performance, reliability, safety certification

- Investment targets: Component suppliers, system integrators⁸⁸

Phase 2 (2028-2030): Service Expansion

- Moderate pricing, scaling volumes

- Focus: Healthcare, hospitality, elder care

- Key metrics: Human interaction safety, task flexibility

- Investment targets: AI software, sensor technologies⁸⁹

Phase 3 (2030+): Consumer Market

- Volume pricing, mass adoption (~1M cumulative units by 2030)

- Focus: Home assistance, personal services

- Key metrics: Cost, ease of use, consumer acceptance

- Investment targets: Platform players, ecosystem developers⁹⁰

Strategic imperatives shape industry evolution

The next 3-5 years represent a critical window for establishing market position before industry consolidation. Success requires identifying which components will remain differentiated versus those destined for commoditization, then timing entry and exit strategies accordingly.

For Humanoid Robot Manufacturers

Vertical Integration Imperatives:

- Critical Actuators: In-house development to avoid supplier dependencies

- AI Chips: Custom silicon for competitive performance and cost advantages

- Safety Systems: Proprietary solutions for regulatory compliance and differentiation

- Manufacturing Processes: Automated assembly to achieve scale economics⁹¹

Strategic Partnership Requirements:

- Proven automotive/electronics manufacturers for production scaling

- University research institutions for talent pipeline and IP development

- Early deployment customers for training data generation

- Regulatory bodies for safety standard development⁹²

For Component Suppliers

Specialization vs. Volume Decision Matrix:

| Strategy | High-Value Specialization | Volume Commoditization |

|---|---|---|

| Target Markets | Research, defense, space | Consumer, light industrial |

| Competitive Advantage | Technical performance | Manufacturing cost |

| Barriers to Entry | High (IP, expertise) | Medium (scale, efficiency) |

| Margin Profile | 40-60% | 10-25% |

| Risk Profile | Lower volume risk | Higher competitive risk |

- Integrated solutions with high switching costs

- Manufacturing presence in key geographic markets (US, China, EU)

- R&D investment to stay ahead of commoditization curve

- Strategic customer relationships with major robot manufacturers⁹⁴

For Governments and Policymakers

Strategic Technology Independence:

- Critical Materials: Domestic processing capabilities for rare earths, lithium

- Semiconductor Manufacturing: Advanced node production for AI chips

- Precision Manufacturing: High-tolerance components and assembly systems

- Talent Development: Engineering programs focused on robotics integration⁹⁵

Regulatory Framework Development:

- Safety standards enabling innovation rather than constraining development

- International cooperation on standards to avoid fragmented markets

- Workforce transition programs for automation-affected industries

- Privacy and security regulations for AI-enabled robots⁹⁶

Economic Security Measures:

- Strategic stockpiling of critical materials and components

- Diversified supplier qualification programs

- Technology transfer restrictions balanced with innovation needs

- Economic incentives for domestic manufacturing development⁹⁷

Conclusion: Navigating the transformation

The transformation from research project to commercial product has begun—those who navigate the complex supply chain dynamics skillfully will define the future of human-robot interaction. The convergence of cost reduction, technological maturity, and market demand creates unprecedented opportunities alongside significant risks.

Success in the humanoid robotics supply chain requires understanding that this is not merely about building robots, but about orchestrating a global network of specialized manufacturers, critical materials, and advanced technologies. The companies and nations that master these dynamics will shape the next phase of human productivity and capability enhancement.

The window for strategic positioning is narrowing. As manufacturing costs continue their dramatic decline and capabilities expand, the supply chain dynamics established in the next 24-36 months will determine competitive positioning for the decade ahead. The future belongs to those who act decisively while the transformation is still accelerating.

References

- Robotics Industry Association, "Humanoid Robot Manufacturing Cost Analysis 2024"

- MarketsandMarkets, "Humanoid Robot Market Global Forecast to 2032"

- U.S. Geological Survey, "Mineral Commodity Summaries 2024"

- BloombergNEF, "Battery Supply Chain Database 2024"

- Semiconductor Industry Association, "Global Semiconductor Manufacturing Capacity"

- NVIDIA Corporation, "Jetson Thor Technical Specifications"

- Tesla Inc., "AI Day 2022 Presentation Materials"

- Boston Consulting Group, "Humanoid Robot Economics Report 2024"

- Tesla Inc., "Optimus Technical Specifications v2.1"

- Harmonic Drive Systems, Annual Report 2024

- Harmonic Drive AG, "Technical Reference Guide 2024"

- ATI Industrial Automation, "Multi-Axis Force/Torque Sensor Catalog"

- TDK InvenSense, "Motion Sensor Solutions for Robotics"

- SynTouch Inc., "BioTac Sensor Technology Whitepaper"

- Battery Council International, "LFP vs NMC Chemistry Comparison 2024"

- Unitree Robotics, "G1 Humanoid Technical Specifications"

- Tesla Inc., "Battery Technology Roadmap 2024"

- Boston Dynamics, "Atlas Technical Documentation v3.0"

- Institute for Defense Analyses, "Rare Earth Elements Supply Chain Analysis"

- Congressional Research Service, "Rare Earth Elements in National Defense"

- China Rare Earth Industry Association, Annual Report 2024

- Contemporary Amperex Technology, "Global Battery Market Analysis"

- Wood Mackenzie, "Lithium Ion Battery Supply Chain Tracker Q4 2024"

- Shenzhen Robotics Association, "Industry Development Report 2024"

- Dongguan Bureau of Industry and Information Technology

- Shanghai Robot Industry Association, Annual Survey 2024

- FANUC Corporation, Annual Report 2024

- International Federation of Robotics, "World Robotics 2024"

- Taiwan Semiconductor Manufacturing Company, "Technology Leadership Report"

- Peterson Institute for International Economics, "Taiwan Strait Economic Impact Analysis"

- International Maritime Organization, "Red Sea Crisis Impact Assessment 2024"

- AutoForecast Solutions, "Global Vehicle Production Impact Analysis"

- Lloyd's of London, "Suez Canal Blockage Economic Impact Study"

- McKinsey Global Institute, "Automation Economics Update 2024"

- Agility Robotics, "Digit Manufacturing Cost Analysis"

- Goldman Sachs Research, "Humanoid Robot Bill of Materials Analysis"

- Harmonic Drive Systems, "Actuator Pricing Guide 2024"

- Tesla Inc., "Full Self-Driving Chip Cost Structure"

- Goldman Sachs, "Robotics Market Outlook Through 2035"

- McKinsey Global Institute, "Economic Impact of Automation"

- Boston Consulting Group, "Robotics Market Growth Projections"

- Research and Markets, "Humanoid Robot Actuator Market Forecast"

- Grand View Research, "Humanoid Robot Market by Region 2024"

- Elon Musk, Tesla Earnings Call Q3 2024

- China Robot Industry Alliance, "Development Roadmap 2024-2050"

- MIT Technology Review, "Manufacturing Scale Economics in Robotics"

- Ark Invest, "Robot Cost Curve Analysis 2024"

- Chinese Academy of Sciences, "Critical Materials Processing Capacity"

- Financial Times, "The 2010-2011 Rare Earth Crisis: Lessons Learned"

- China Ministry of Commerce, "Export Control Regulations 2024"

- China National Materials Storage Bureau, Strategic Reserve Report

- Reuters, "China's Critical Minerals Export Controls Timeline"

- Wall Street Journal, "U.S.-China Technology Trade Restrictions 2024"

- Harmonic Drive Systems, "Global Demand Forecast 2025-2030"

- Industrial Fasteners Institute, "High-Precision Screw Production Capacity"

- Machine Tool Technologies Research Foundation, "Precision Manufacturing Bottlenecks"

- China Battery Industry Association, "Global Market Share Analysis"

- Semiconductor Industry Association, "Geographic Production Distribution"

- U.S. Department of Commerce, "CHIPS Act Implementation Guidelines"

- U.S. Department of Defense, "Critical Materials Supply Chain Investment"

- U.S. Congress, "Creating Helpful Incentives to Produce Semiconductors Act of 2022"

- European Commission, "Strategic Autonomy Action Plan 2030"

- Japan Ministry of Economy, Trade and Industry, "Economic Security Strategy"

- Center for Strategic and International Studies, "Rebuilding Rare Earth Supply Chains"

- Deloitte, "Supply Chain Resilience Survey 2024"

- McKinsey & Company, "The Cost of Supply Chain Diversification"

- Institute for Supply Management, "Inventory Strategy Shift Analysis"

- Figure AI Inc., "Actuator Technology Comparison Study"

- Agility Robotics, "Digit Design Philosophy Whitepaper"

- Tesla Inc., USPTO Patent Portfolio Analysis

- Boston Dynamics, Patent Landscape Report 2024

- NASA Technology Transfer Program, "Series Elastic Actuator Patents"

- Harmonic Drive Systems, "Intellectual Property Portfolio 2024"

- Agility Robotics, "Manufacturing Economics at Scale"

- Figure AI Inc., "Automated Manufacturing Strategy"

- Tesla Inc., "Autopilot Data Collection Statistics"

- NVIDIA Corporation, "Omniverse Synthetic Data Generation"

- BMW Group, "Factory Robotics Data Collection Program"

- OpenAI, "Robotics Integration Partnership Announcements"

- Boston Consulting Group, "Manufacturing Innovation Impact Study"

- Harmonic Drive Systems K.K., Financial Analysis Report 2024

- Raymond James, "NVIDIA Robotics Market Opportunity Analysis"

- Velodyne Lidar Inc., "Solid-State LiDAR Market Penetration"

- Umicore N.V., "Battery Materials Market Position"

- National Science Foundation, "Robotics Research Investment Trends"

- China Securities Regulatory Commission, "Robotics Sector Investment Guide"

- European Robotics Association, "Market Opportunity Assessment 2024"

- PwC, "Industrial Robotics Investment Landscape"

- Accenture, "Service Robotics Market Timing Analysis"

- Bain & Company, "Consumer Robotics Adoption Timeline"

- Harvard Business Review, "Vertical Integration in Emerging Technologies"

- Stanford Research Institute, "Strategic Partnership Models in Robotics"

- MIT Sloan Management Review, "Component Supplier Strategy Matrix"

- Supply Chain Management Review, "Critical Success Factors Analysis"

- Council on Foreign Relations, "Technology Independence Strategy"

- Brookings Institution, "Robotics Regulatory Framework Development"

- Center for American Progress, "Economic Security in Advanced Manufacturing"