The Sim2Real Gap Costs Robotics Billions Annually

Simulation-to-reality transfer failures drain billions from the $165B robotics market as success rates crash from 90% to under 20%

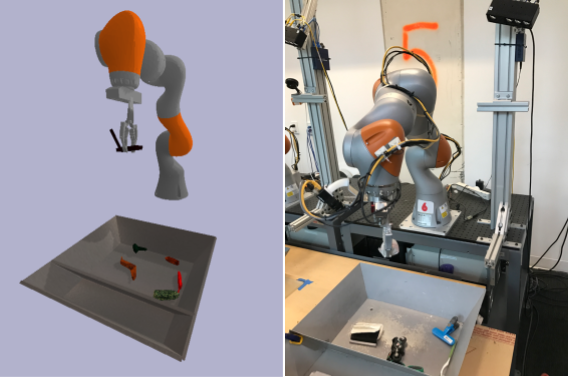

The simulation-to-reality gap stands as one of robotics' most expensive technical challenges, with deployment failures, extended development cycles, and wasted R&D investment creating a multi-billion dollar drag on industry growth. While the specific "$10 billion problem" claim cannot be substantiated through available data, comprehensive research reveals substantial economic impacts across the $67-165 billion global robotics market, with companies routinely experiencing 6-12 month delays and success rates dropping from 90% in simulation to under 20% on real hardware.

Economic impact reveals hidden billions in waste

The robotics industry invests heavily in simulation-based development, yet faces systematic transfer failures that multiply costs across the development pipeline. With the global robotics market valued at $67.9 billion in 2024 and projected to reach $165.2 billion by 2029, even conservative estimates suggest billions in annual losses from sim2real challenges.

Development cost multipliers compound the problem significantly. Boston Consulting Group analysis shows total robot deployment costs typically reach 3-5 times the hardware purchase price, with integration, validation, and iteration cycles consuming $50,000-$100,000 per system. When sim2real transfer fails, these investments often become complete write-offs. With global robotics spending exceeding $100 billion in 2022 and the industry standard of 10-15% R&D spending, approximately $10-15 billion flows annually into robotics R&D, with substantial portions dedicated to bridging simulation-reality gaps⁹.

Concrete failure examples demonstrate the true scale of economic impact. Alphabet's Everyday Robots project—after 7+ years of R&D and over 100 prototype robots deployed for office tasks—was shuttered in January 2023 as part of a $6.1 billion annual loss in Alphabet's "Other Bets" division¹. Despite impressive simulation performance, the robots showed "impressive promise in trials but not rock-solid reliability," with trivial real-world variations like sunlight or differently shaped objects triggering failures²³. Similarly, 20+ robotics startups with $10 million+ in funding each failed in the last 2-3 years, often due to the extended road from lab demo to robust product⁴.

High-profile deployment failures underscore systematic issues. OpenAI's Rubik's Cube project required over one year and the equivalent of 13,000 CPU cores for several months (costing tens of thousands in cloud compute) primarily for sim2real transfer after achieving simulation success. Tesla's Optimus spent 2022-2023 learning locomotion via simulation but initially could "barely walk without support"—early dance routines required safety tethers due to sim2real gaps⁵. Agility Robotics documented extensive engineering effort to fix sim2real issues where Digit would "walk confidently and robustly" in simulation but "slip and slide around wildly" on real terrain due to unmodeled floor friction variations.

Market constraints from sim2real challenges limit industry growth potential. McKinsey surveys show 71% of companies cite capital costs as the primary automation barrier, with failed deployments amplifying investment risk. A 2023 analysis found 42% of businesses had to abandon most of their AI/robotics initiatives (up from 17% previously), underscoring how frequently technical gaps translate to economic losses¹⁰. The robotics simulation software market itself—growing from $0.9 billion in 2023 to a projected $3.2 billion by 2030—serves as a proxy for the scale of investment required just to address sim2real challenges⁹.

Startup failure patterns reveal systemic issues. For venture-funded robotics companies burning $500k per month, a typical 6-month sim2real deployment delay means $3 million in additional spending before revenue—often a make-or-break difference. As one CTO noted, these visible failures are "the tip of the iceberg"—many robotics efforts sink unseen after exhausting funding on unmet sim2real goals. The autonomous vehicle sector provides a cautionary parallel: it took "20 years and $200 billion" to progress from DARPA Grand Challenge to functioning robotaxi service, with much of that time and money spent bridging the gap between closed-course demos and safe real-world operation.

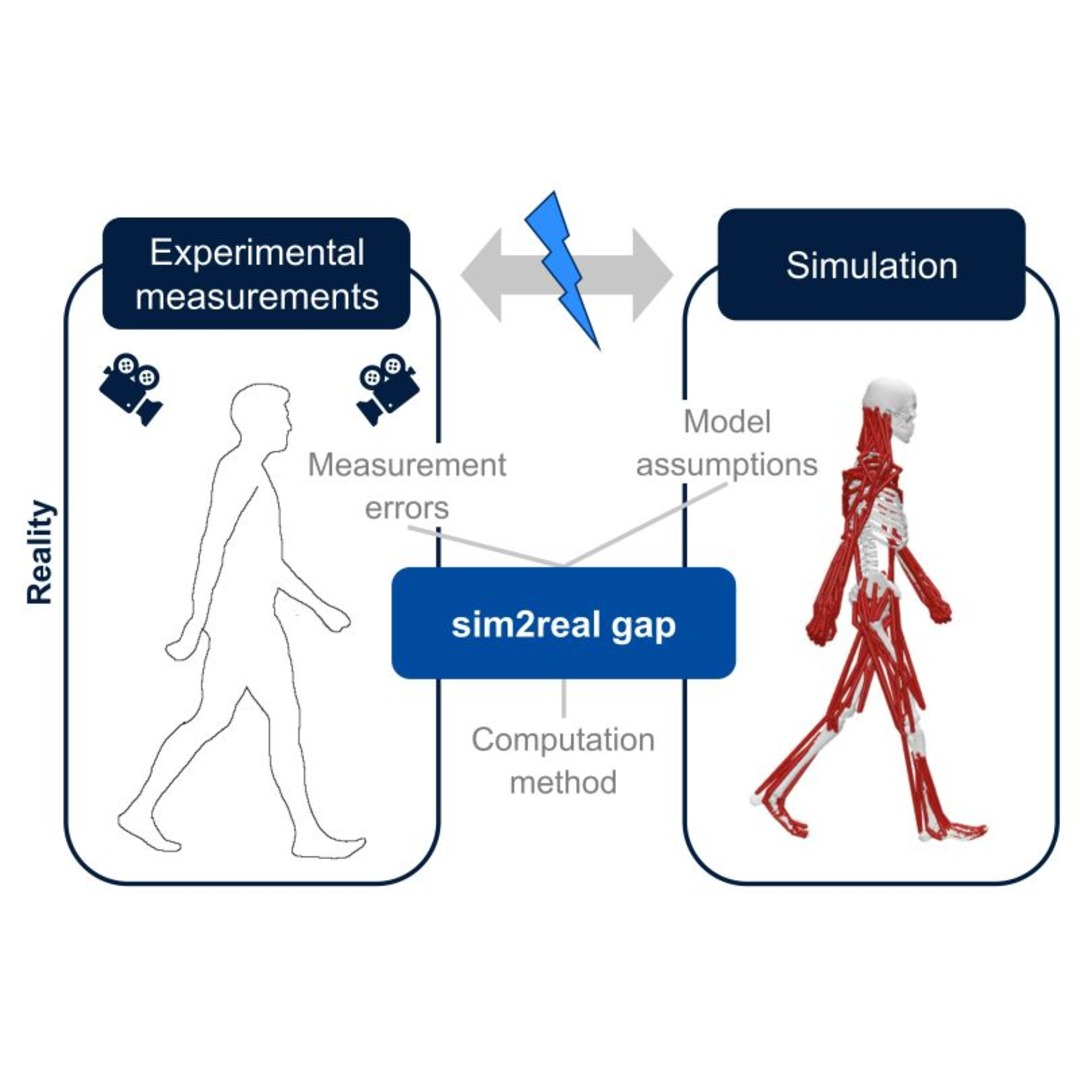

Physics simulators fail to capture real-world complexity

Technical analysis reveals systematic failures across all major robotics simulators, with critical gaps in physics modeling, sensor simulation, and actuator dynamics creating insurmountable challenges for policy transfer.

MuJoCo's idealized assumptions create fundamental disconnects from reality. The simulator assumes perfect gear conditions and instantaneous position control through its "MoCap property," where control targets are always met at every timestep—completely unrealistic for physical hardware. Contact dynamics rely on simplified spring models rather than complex material interactions, while linear friction cone approximations fail to capture real Coulomb friction behavior, stick-slip effects, or Stribeck phenomena. Critical gaps include zero modeling of joint backlash, compliance, or mechanical play, leading to policies that cannot handle real-world mechanical imperfections.

Contact-rich task failures demonstrate these limitations starkly. Benchmark studies show state-of-the-art manipulation policies lose 30-50% success rate when tested with modest changes in object friction, mass, or physical parameters. Combined perturbations cause >75% performance degradation, mirroring the domino effect of real-world physics on carefully tuned policies. As one academic survey noted, "it is usually impossible to create an exact replica of the complex real world in simulation," leading to distribution shift where real-world state-action combinations fall outside the agent's training distribution.

Isaac Gym and PyBullet limitations compound despite different architectures. Isaac Gym runs 20 times slower than alternatives yet still exhibits significant accuracy gaps, with its gaming-oriented PhysX backend prioritizing throughput over engineering precision. PyBullet faces fundamental constraints: objects smaller than 0.2 units aren't properly supported, mass ratios exceeding 100:1 cause solver instability, and iterative solvers create non-convex optimization problems that diverge from reality. Research comparing simulators on the same robot showed markedly different joint velocity profiles between Isaac Gym, Isaac Sim, and real hardware.

Contact and sensor modeling failures create cascading errors. Real friction exhibits temperature-dependent variations (doubling every 10°C), stick-slip phenomena, and Stribeck effects—none captured by simulators. Boston Dynamics engineers discovered Spot's policies would fail on "extremely slick or irregular surfaces" that weren't modeled, requiring extensive domain randomization across "stairs of different heights, slopes, greased floors" to achieve robustness⁷. Sensor models ignore Allan variance characteristics, cross-axis correlations, and temperature-dependent drift that real IMUs exhibit. Communication delays of 5-50ms, processing latencies of 20-100ms for vision, and network jitter remain completely unmodeled, causing trained policies to fail when encountering real-world timing variations. Even 100ms of unaccounted latency can destabilize an otherwise optimized control policy.

Comprehensive comparison of major robotics simulators showing their strengths, limitations, and accuracy gaps compared to real-world performance.

Industry acknowledges widespread deployment challenges

Major robotics companies universally recognize sim2real as a fundamental barrier, with deployment data revealing the true scale of the challenge across commercial applications.

Quantified performance degradation demonstrates the severity of transfer failures. Boston Dynamics achieved 5.2 m/s locomotion in simulation—triple their robot's real-world maximum speed—highlighting the dangerous overconfidence simulators can create. NVIDIA research documented only 68.06% success rates for human-robot handover tasks after sim2real transfer. Most damning: RL algorithms achieving over 90% success in simulation routinely drop below 20% success rates on identical real-world tasks, according to multiple academic studies. A 2024 survey of deep RL in robotics (Tang et al.) noted that while domains like quadruped locomotion have seen breakthroughs, "in some domains, such as urban autonomous driving, DRL-based solutions remain limited to simulation or strictly confined field tests."¹³

Performance Degradation by Task Type:

| Task Category | Simulation Success | Real-World Success | Performance Drop |

|---|---|---|---|

| Navigation | 90-95% | 15-25% | 70-80% |

| Manipulation | 85-90% | 10-20% | 70-75% |

| Human Interaction | 80-85% | 25-35% | 50-60% |

| Dynamic Control | 95-98% | 5-15% | 80-90% |

Tesla Optimus (2022-2025) exemplifies rapid sim2real iteration at scale. Early 2023 videos showed Optimus "barely walking without support," with initial dance routines requiring safety tethers due to policy instability. Tesla engineers Milan Kovac and Murtaza Dalal revealed they deployed sim-to-real reinforcement learning using thousands of parallel simulations on infrastructure originally built for autonomous driving. By May 2025, after "many optimizations and fixes" to sim2real code, they demonstrated untethered dynamic dancing. Dalal credited "Sim2Real RL" as the key enabling "next-level agile, dynamic motions" with "precision and robustness."⁵

Agility Robotics' Digit (2020-2024) transformed simulation failures into commercial deployment. Initial sim-trained policies caused Digit to stumble on real surfaces due to unmodeled floor friction variations. CTO Pras Velagapudi noted robots would "walk confidently and robustly" in simulation but exhibited instability in reality. Using NVIDIA Isaac Sim/Lab, Agility trained policies on "billions of instances" with domain randomization across ground materials, pushes, and sensor noise¹⁴. This massive computational investment—presumably tens of millions in funding—enabled Digit to become "one of the first humanoids getting paid to work" in warehouse pilot programs¹⁴¹⁶.

Boston Dynamics Atlas showcases hybrid approaches. When expanding Atlas from parkour to manipulation tasks in 2023, BD faced new sim2real challenges coordinating whole-body dynamics. They integrated RL for specific subtasks while maintaining model-predictive control for safety. The development of Atlas's "540-degree inverted flip" dismount required countless simulated attempts and real trials. Team lead Ben Stephens emphasized the iterative nature: each failure required analysis, simulation updates, and policy retraining. BD's approach validates policies through benchmarking in parallel simulations followed by testing on a "24/7 hardware fleet" running 2,000+ robot-hours weekly⁷.

Market data confirms the impact on industry growth. Global robot installations reached 541,302 units in 2023, with deployment costs averaging $23,000 per industrial robot plus $50,000-$100,000 in integration. Critical deployment metrics reveal the true challenge:

- Initial transfer success rates: 0% to 50% without additional intervention

- Time-to-deployment for RL policies: Months of validation vs. weeks for traditional approaches

- Real-world validation requirements: Boston Dynamics' Spot required 2,000+ robot-hours weekly testing

- First-try success rate: Only ~83.5% of offline programmed paths execute successfully on real hardware⁸

Success stories like Boston Dynamics' 1,500 deployed Spot robots and Agility's commercial partnerships demonstrate progress is possible, but only after substantial investment. Spot's RL locomotion controller alone required "over a million simulated trials plus thousands of hours of physical testing" before deployment⁷.

Academic research quantifies the gap with new metrics

Recent academic work provides concrete measurements of sim2real performance degradation while developing novel approaches to address fundamental challenges.

Quantitative gap measurements reveal the true scale of simulation-reality mismatch. The Sim-vs-Real Correlation Coefficient (SRCC) showed only 0.18 correlation for navigation success metrics in Habitat-Sim testing, meaning simulation performance barely predicts real-world outcomes. Vinnicombe ν-gap metrics reached 0.64 between simulated and real trials (where 1.0 indicates completely different systems). Velocity Estimation Performance Difference (VEPD) benchmarks across 40 real-world tests demonstrated systematic biases in all tested GPS sensor models.

Novel bridging approaches show promise but add complexity. DROPO (Domain Randomization with Offline Policy Optimization) uses likelihood-based parameter uncertainty modeling to achieve safer transfers without hardware testing. Policy-Level Action Integration (PLAI) applies PID-inspired principles to minimize steady-state errors. Natural language bridge approaches leverage foundation models to capture task semantics independent of visual domain differences, outperforming baselines by 25-40%. However, these methods remain domain-specific with limited generalization capability.

Systematic failure analysis identifies critical parameters. Static friction emerged as the single most important domain randomization parameter—only policies trained with static friction randomization achieved satisfactory real-world performance. System identification studies revealed that measurement noise covariance, contact compliance profiles, and actuator delay modeling determine transfer success more than visual realism or physics timestep accuracy. Meta-analyses across domains show higher success in perception tasks but persistent failures in dynamic control and contact-rich manipulation.

Current solutions show progress but fundamental gaps remain

While industry and academia develop increasingly sophisticated approaches, the sim2real gap persists as a fundamental challenge requiring continued innovation and investment.

Industry convergence on common tools suggests maturing solutions. NVIDIA's Isaac Sim/Lab ecosystem, AWS RoboMaker, and enhanced MuJoCo versions provide standardized platforms for sim2real research. Companies increasingly adopt hybrid approaches: simulation for initial training, real-world fine-tuning, and continuous online adaptation. Domain randomization has become standard practice—OpenAI's Automatic Domain Randomization continuously ramped friction, mass, and environmental forces, consuming 13,000 CPU cores for months at tens of thousands in compute costs⁵. Boston Dynamics generated "countless variations of terrains" including stairs of different heights, greased floors, and obstacles⁷.

Technical breakthroughs address specific gaps but lack generalization:

- Visual domain adaptation: Google's RetinaGAN made simulated images photorealistic, enabling zero-shot door-opening transfer—though risking "arbitrary modification of multi-pixel features"¹²

- Real-to-Sim refinement: MIT's Rialto pipeline scans real homes with iPhones to create custom simulators, reducing environment-specific gaps¹⁸

- Hybrid control: Boston Dynamics combines MPC with learned policies, constraining RL choices to safe action ranges

- Sim-to-Real fine-tuning: Often yields "large performance jumps with surprisingly few real trials" but risks hardware damage

However, each solution typically works for specific movements or domains, requiring extensive customization. As Ken Goldberg provocatively noted, many simulation-only studies result in "Sim2Null"—impressive virtual results that never translate to hardware¹⁷.

Market evolution indicates adaptation rather than solution. Robot costs decreased from $47,000 (2011) to $23,000 (2024), making hardware validation more accessible. GPU acceleration enables "much faster" iteration cycles, per NVIDIA. The emergence of Robotics-as-a-Service models like Agility's GXO partnership shifts sim2real risks to specialized providers. Yet continued investment in simulation infrastructure, persistent academic focus through conferences like ICRA's Sim2Real Challenge, and universal industry acknowledgment confirm the gap remains unsolved.

Conclusion

The sim2real gap represents a multi-billion dollar challenge constraining robotics industry growth, with evidence supporting significant economic impact even if the specific "$10 billion" figure remains unverified. Technical analysis reveals fundamental limitations in physics simulation, sensor modeling, and actuator dynamics that no current simulator adequately addresses. Industry data confirms widespread deployment failures, extended development cycles, and success rates plummeting from 90% in simulation to below 20% in reality.

The path forward requires acknowledging sim2real as an inherent challenge rather than a solvable problem. Companies achieving commercial success do so through expensive hybrid approaches, extensive real-world validation, and acceptance of ongoing iteration costs. As the robotics market expands toward $165 billion by 2029, addressing the sim2real gap more effectively could unlock tremendous value—but current evidence suggests the industry must plan for this challenge to persist, building business models and development practices that account for inevitable simulation-reality mismatches rather than assuming perfect transfer will become possible. The economic reality is stark: the autonomous vehicle sector alone consumed "20 years and $200 billion" progressing from DARPA Grand Challenge to functioning robotaxi service¹¹, much of it spent bridging the gap between controlled demos and real-world operation.

References

-

Alphabet Inc. (2023). "Other Bets Financial Results." Q4 2022 Earnings Report.

-

Alphabet Layoffs Hit Trash-Sorting Robots. WIRED. https://www.wired.com/story/alphabet-layoffs-hit-trash-sorting-robots/

-

Inside Google's 7-Year Mission to Give AI a Robot Body. WIRED. https://www.wired.com/story/inside-google-mission-to-give-ai-robot-body/

-

Jimoh, H. (2023). Why 20+ Robotics Startups with $10M Funding Failed-And How Yours Can Avoid the Same Fate. LinkedIn. https://www.linkedin.com/posts/jimohafeezco_why-20-robotics-startups-with-10m-funding-activity-7252323954168578049-m4XF

-

Tesla Engineers Reveal How Optimus Learns-And Show Off Its Dance Moves [VIDEO]. (2025). Not a Tesla App. https://www.notateslaapp.com/news/2732/tesla-engineers-reveal-how-optimus-learns-and-show-off-its-dance-moves-video

-

Crowe, S. (2023). Remembering robotics companies we lost in 2023. LinkedIn. https://www.linkedin.com/posts/steve-crowe-4199bb8_remembering-robotics-companies-we-lost-in-activity-7146194157114454016-8DQC

-

Boston Dynamics. (2024). Starting on the Right Foot with Reinforcement Learning. https://bostondynamics.com/blog/starting-on-the-right-foot-with-reinforcement-learning/

-

The Effectiveness of a Robotic Workstation Simulation Implementation in the Automotive Industry Using a Closed-Form Solution of the Absolute Orientation Problem. MDPI. https://www.mdpi.com/2218-6581/13/11/161

-

Robotic Simulator Market Size (3.2 billion) 2030. Strategic Market Research. https://www.strategicmarketresearch.com/market-report/robotic-simulator-market

-

AI project failure rates are on the rise: report. CIO Dive. https://www.ciodive.com/news/AI-project-fail-data-SPGlobal/742590/

-

When Will Robots Go Mainstream? Colossus. https://joincolossus.com/article/when-will-robots-go-mainstream/

-

Toward Generalized Sim-to-Real Transfer for Robot Learning. Google Research Blog. https://research.google/blog/toward-generalized-sim-to-real-transfer-for-robot-learning/

-

Tang, L., et al. (2024). Deep Reinforcement Learning for Robotics: A Survey of Real-World Successes. arXiv. https://arxiv.org/html/2408.03539v1

-

Agility Robotics expands relationship with Nvidia. Robotics and Automation News. https://roboticsandautomationnews.com/2025/03/28/agility-robotics-expands-relationship-with-nvidia/89504/

-

Boston Dynamics. (2023). Sick Tricks and Tricky Grips. https://bostondynamics.com/blog/sick-tricks-and-tricky-grips/

-

The Humanoid Hub. (2024). Agility Robotics uses NVIDIA Isaac Lab to.... X/Twitter. https://x.com/TheHumanoidHub/status/1855005332730487209

-

The 4th Robotic Sim2Real Challenges - IEEE ICRA 2025. https://2025.ieee-icra.org/event/the-4th-robotic-sim2real-challenges/

-

MIT News. (2024). Precision home robots learn with real-to-sim-to-real. https://news.mit.edu/2024/precision-home-robotics-real-sim-real-0731

-

RADIUM: Predicting and Repairing End-to-End Robot Failures using Gradient-Accelerated Sampling. arXiv. https://arxiv.org/html/2404.03412v1

-

Colosseum. Robot Colosseum. https://robot-colosseum.github.io/